Despite daily lamentations of its customers over glitch on its mobile application, Guaranty Trust Bank, GTBank has been recognised as the ”Best Bank in Nigeria” at the Euromoney Awards for Excellence 2023.

GTBank had announced an app update, informing its millions of customers through text and email that it would automatically update to the new version on July 12.

There is, however, caused a widespread outcry and lamentations as customers expressed their frustration over log-in difficulties and other issues in the updated app of the bank.

But in a statement on Monday, the bank said that the latest recognition by Euromoney underscored the bank as the leading financial institution in Nigeria.

Announcing the award, Euromoney said: “Nigeria’s best bank, Guaranty Trust Bank, has continued to do a good job of convincing investors that it is better placed than its key competitors to deal with the risks ahead and perhaps to take advantage of opportunities in economic and policy transition.

“Despite a difficult operating environment, the bank continues to deliver exceptional results as the flagship franchise of Guaranty Trust Holding Company Plc.

“It recorded a profit before tax of N214.2 billion, pre-tax return on Equity (ROAE) of 23.6 per cent, and Cost to Income Ratio (CIR) of 48.0 per cent for the period ended, Dec. 31, 2022.”

Euromoney is an authority for global banking and financial markets and the annual awards for excellence, celebrates financial institutions that demonstrate leadership, innovation, and resilience in the markets they operate.

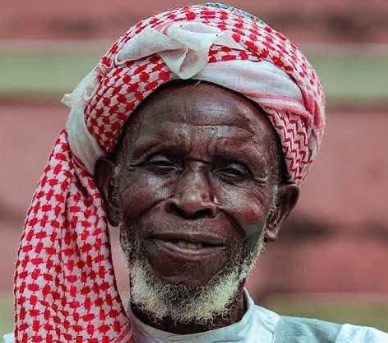

Commenting on the award, Miriam Olusanya, managing director of Guaranty Trust Bank Ltd., said, “we are honoured to be named the Best Bank in Nigeria by Euromoney.

“This recognition reflects our unwavering commitment to the values of excellence and innovation which form the bedrock of our value proposition as an institution and has guided the mother-brand to achieve remarkable success for over 30 years.

“As part of a thriving financial holding company, we will continue to prioritise service delivery and innovation whilst maintaining our strong financial performance,” she said.

NAN

Advertisement