The Federation Account Allocation Committee says it shared N907.05bn among the three tiers of government for June 2023.

The figure represents a marginal increase of N120.89bn compared to the N786.16bn shared for May 2023, and it is the highest this year and the second increase following a constant decline since January.

FAAC disclosed this in a communiqué issued at the end of its latest meeting in Abuja on Thursday.

The meeting was chaired by the new Accountant General of the Federation, Dr Oluwatoyin Madein.

The PUNCH observed, however, that the increase recorded for May was higher than that of June despite the fuel subsidy removal.

The total amount includes gross statutory revenue, Value Added Tax, and electronic money transfer levies and exchange rate difference revenue.

The communique read, “The N907.05bn total distributable revenue comprised distributable statutory revenue of N301.50bn, distributable Value Added Tax revenue of N273.23bn, Electronic Money Transfer Levy revenue of N11.44bn and Exchange Difference revenue of N320.89bn.”

The Federal Government received N345.56bn, the states received N295.95bn, and the local government councils got N218.06bn, while the oil-producing states received N47.48bn as derivation (13 per cent of mineral revenue).

It was also disclosed that a gross statutory revenue of N1.15tn was received for the month of June 2023, which was higher than the sum of N701.79bn received in the previous month by N451.13bn.

The communique added, “From the N301.50bn distributable statutory revenue, the Federal Government received N146.71bn, the State Governments received N74.41bn and the Local Government Councils received N57.37bn. The sum of N23.01bn was shared to the relevant States as 13 per cent derivation revenue.

“For the month of June 2023, the gross revenue available from the Value Added Tax was N293.41bn. This was higher than the N270.2bn available in the month of May 2023 by N23.21bn. The Federal Government received N40.98bn, the State Governments received N136.61bn and the Local Government Councils received N95.63bn from the N273.23bn distributable Value Added Tax revenue.

‘The N11.44Bn Electronic Money Transfer Levy was shared as follows: the Federal Government received N1.72bn, the State Governments received N5.72bn and the Local Government Councils received N4bn.

“From the N320.89bn Exchange Difference revenue, the Federal Government received N156.16bn, the State Governments received N79.20bn, the Local Government Councils received N61.06bn and the sum of N24.47bn was shared to the relevant States as 13 per cent mineral revenue.”

It was further disclosed that in June 2023, the total deductions for cost of collection was N73.24bn and total deductions for savings, transfers and refunds was N979.08bn.

“The balance in the Excess Crude Account was $473,754.57,” it added.

According to the communiqué, in June 2023, Companies Income Tax recorded tremendous increase. Import and Excise Duties, Value Added Tax, Oil and Gas Royalties increased significantly, while Petroleum Profit Tax and Electronic Money Transfer Levy decreased considerably.

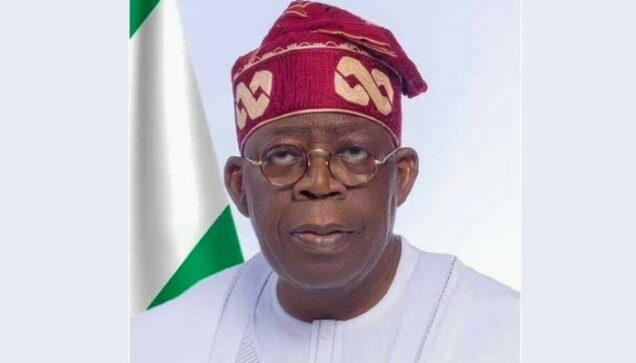

In a separate statement from the state house on Thursday, Special Adviser to the President, Special Duties, Communications & Strategy, Dele Alake, it was noted that President Bola Tinubu has approved the establishment of Infrastructure Support Fund for the 36 States of the Federation as part of measures to cushion the effects of the petrol subsidy removal on the people.

The statement added, ”The new Infrastructure Fund will enable the States to intervene and invest in the critical areas of Transportation, including farm to market road improvements; Agriculture, encompassing livestock and ranching solutions; Health, with a focus on basic healthcare; Education, especially basic education; Power and Water Resources, that will improve economic competitiveness, create jobs and deliver economic prosperity for Nigerians.

“The committee also resolved to save a portion of the monthly distributable proceeds to minimize the impact of the increased revenues-occasioned by the subsidy removal and exchange rate unification-on money supply, as well as inflation and the exchange rate.”

The statement also disclosed that about N790bn would be saved to “complement the efforts of the Infrastructure Support Fund (ISF) and other existing and planned fiscal measures, all aimed at ensuring that the subsidy removal translates into tangible improvements in the lives and living standards of Nigerians.”

PUNCH

Advertisement