The Presidency has strongly refuted claims made by former Minister of Transportation, Rotimi Amaechi, over Nigeria’s newly implemented tax reforms, describing his comments as misleading and inaccurate.

In a viral video circulating online, Amaechi warned Nigerians of dire economic consequences should the ruling All Progressives Congress (APC) retain power in the 2027 general elections. He alleged that the government planned to enforce a tax regime that would automatically deduct 25 per cent from large transactions, claiming such a move would trigger a ripple effect of price increases across sectors.

According to him, a contractor paid ₦100 million for building materials would instantly lose ₦25 million to tax deductions. He argued that landlords and business owners would pass on the additional costs to tenants and consumers, ultimately affecting professionals such as doctors, artisans, and other service providers.

Amaechi, who defected to the African Democratic Congress in 2025, further questioned why the alleged tax measure had not been introduced before the elections, suggesting it was being delayed to avoid political backlash. He urged Nigerians to take the issue seriously, saying it would impact families’ ability to meet essential needs like school fees and daily living expenses.

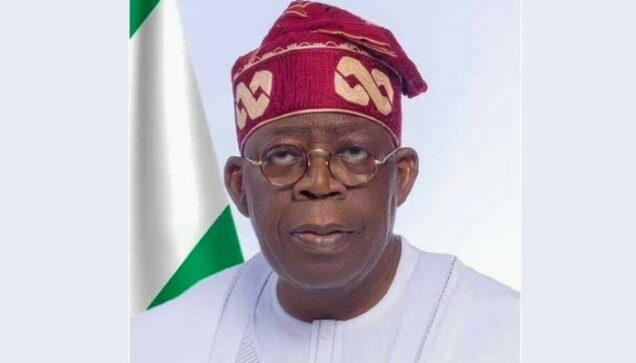

However, reacting to the claims, the Special Adviser to President Bola Tinubu on Information and Strategy, Bayo Onanuga, dismissed the assertions as “egregious lies.”

Onanuga accused the former Rivers State governor of misrepresenting the provisions of the Tax Act, insisting that the law does not contain the deductions Amaechi described. He also questioned whether such claims signaled the opposition’s campaign approach ahead of the 2027 elections.

The tax reforms, which took effect on January 1, 2026, were signed into law in June 2025. The legislation consolidates more than 70 separate taxes, renames the Federal Inland Revenue Service to the Nigeria Revenue Service, and introduces provisions for digital asset taxation.

While critics argue that aspects of the reforms could place additional strain on low-income earners, government officials maintain that the changes are designed to streamline tax administration, improve compliance, and strengthen Nigeria’s long-term economic stability.

The debate over the new tax regime is expected to remain a key issue in the lead-up to the next general elections, as political actors continue to frame the reforms through competing narratives.

Advertisement