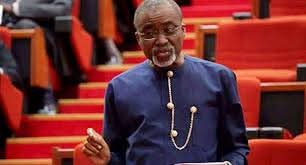

Senate President Godswill Akpabio faced criticism from the Nigeria Labour Congress (NLC), Trade Union Congress (TUC), and the Nigeria Employers Consultative Association (NECA) following his recent comments that only 30 percent of Nigerians pay taxes, yet many demand more from the government.

Akpabio made this remark during the opening of a two-day public hearing on tax reforms in Abuja, where he emphasized that tax reforms are crucial for Nigeria’s future and must be implemented properly.

In response, the NLC, TUC, and NECA argued that tax evasion is a result of a government that remains unaccountable to its citizens. They further stated that Nigerians would be more inclined to pay taxes if they saw tangible benefits from the government.

President Bola Tinubu, through the Chairman of the Senate Committee on Finance, Senator Sani Musa, expressed his support for the bills under discussion and emphasized that the Senate should provide workable laws based on these proposals.

Various stakeholders, including the Nigerian National Petroleum Corporation (NNPCL), Revenue Mobilisation and Fiscal Allocation Commission (RMFAC), National Association of Chamber of Commerce, Industry, and Agriculture (NACCIMA), and others, also expressed their support for the tax reform bills. The bills, which include the Nigeria Tax Bill (NTB) 2024, Nigeria Tax Administration Bill (NTAB) 2024, Nigeria Revenue Service (Establishment) Bill (NRSEB) 2024, and Joint Revenue Board (Establishment) Bill (JRBEB) 2024, had already passed their second reading in the Senate and were sent to the Finance Committee for further review.

Akpabio stated that the tax reform bills were key to Nigeria’s future and that the Senate would not rush the process, opting instead for a detailed, clause-by-clause examination.

He condemned the poor tax culture in the country, pointing out that only 30 percent of Nigerians pay taxes while the majority demand better infrastructure, education, and security. He stressed that the reform would aim to ensure better resource allocation for national development, with a focus on improving government accountability.

The Senate President also criticized leaders who had not read the bills before attacking the process, urging Nigerians to base their opinions on the bills themselves rather than on social media misinformation. He called for informed debates that would lead to the creation of a tax system that benefits all Nigerians.

Senator Musa, in his remarks, affirmed that President Tinubu’s goal was to introduce a workable tax system, and he emphasized the importance of inclusivity in the discussions around the reforms.

Mele Kyari, the Group Chief Executive Officer of NNPCL, voiced strong support for the reform, highlighting its potential to simplify the tax system and enhance profitability within the industry. Other stakeholders, including the RMFAC and the Arewa Think Tank, also expressed their backing for the reform bills.

In contrast, the NLC’s official response criticized Akpabio’s remarks, asserting that Nigerians are reluctant to pay taxes due to a lack of trust in the government’s accountability. They argued that a government failing to provide basic services and demonstrating fiscal responsibility cannot expect citizens to willingly contribute their resources.

The TUC’s Deputy President, Dr. Tommy Okon, also questioned Akpabio’s claim, pointing out that the Federal Inland Revenue Service (FIRS) consistently surpasses its targets, and the wealthy often evade taxes rather than the working class, who have taxes automatically deducted. He challenged Akpabio to specify which groups are evading taxes instead of making broad, unverifiable claims.

NECA, through its Director-General Adewale-Smatt Oyerinde, echoed similar sentiments, stating that while many Nigerians may not pay taxes, the government is partly to blame for this situation.

Oyerinde emphasized that citizens are more likely to contribute if they see the direct benefits of their taxes and if the government demonstrates greater accountability in the use of tax revenues.

Vanguard

Advertisement