Nigerians who earn less than N250,000 per month will be exempt from paying income tax starting January 2026, according to Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms.

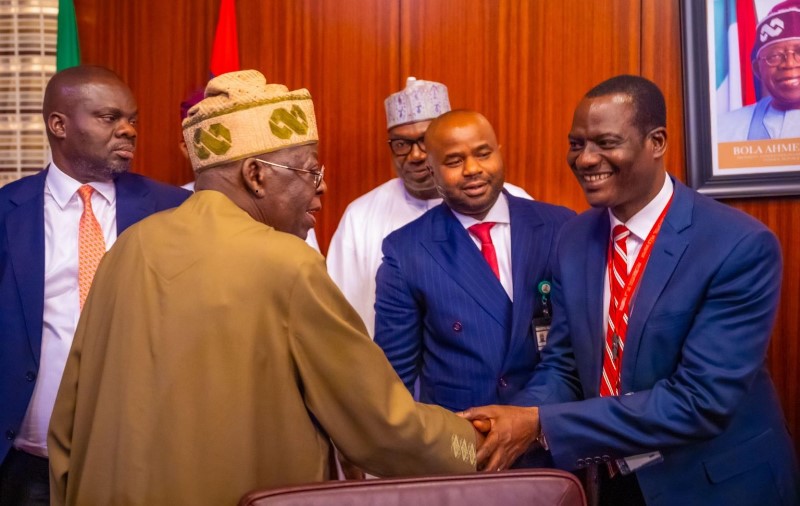

Speaking during an interview on Politics Today on Channels Television, Oyedele explained that the exemption is part of a broader set of tax reforms signed into law by President Bola Tinubu on June 26.

The move is aimed at easing the financial burden on low-income households, which are now officially categorized as poor under the new policy.

“These reforms are not about increasing taxes,” Oyedele said. “They’re designed to promote economic growth, ensure fairness, and boost compliance. If you’re struggling, the government shouldn’t take what little you have.”

Key Features of the New Tax Policy

Income Tax Exemption: Individuals or households earning below ₦250,000 monthly are no longer required to pay income tax.

Relief for Middle-Income Earners: Tax rates will be reduced for those earning between ₦1.8 million and ₦2 million annually (approximately ₦150,000 to ₦167,000 per month).

Adjustment for High-Income Brackets: A modest increase in tax rates will apply to higher-income earners.

Oyedele said the reforms are based on a nuanced understanding of Nigeria’s socio-economic realities. He noted that an average household is estimated to consist of five members supported by two working adults.

“A household earning ₦250,000 monthly is barely able to cover basic needs,” he said. “Taxing them would only push them further into hardship.”

Boosting Tax Efficiency

He also addressed Nigeria’s low tax compliance rate, which currently captures only about 30% of potential revenue. The new reforms aim to improve efficiency and close the remaining 70% gap.

“This is a people-centered reform,” Oyedele added. “The objective is to shield vulnerable citizens while ensuring that those with higher incomes contribute more equitably.”

Oyedele, who was appointed in July 2023, described his role leading the reform initiative as both “challenging and rewarding,” underscoring the importance of building a fairer and more effective tax system.

Advertisement